Avoiding IRS Red Flags

Author: Keith Huggett

Author: Keith Huggett

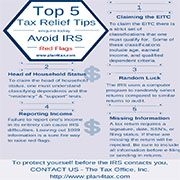

When it comes to the IRS everyone likes to avoid them if possible. Sometimes you can, sometimes you can't. It's always helpful to have some tax relief tips to illustrate ways to keep them at bay. Suffering through a tax audit is no fun; it's often an intimidating, time-consuming process that can turn out to be very costly, especially if additional penalties are assessed. To illustrate the top 5 tips for avoiding IRS red flags, the Tax Office, Inc., has put together a short infographic, the Top 5 Tax Relief Tips, to assist you.

In order to avoid the IRS flags, it is imperative that you report 4 out of the 5 tips correctly. Unfortunately one comes down to blind luck and there isn't a lot you can do to influence that.

1. The Earned Income Credit - To qualify for the EITC, you must follow the rules and file a tax return even if you do not owe any tax or are not required to file. To see if you qualify for the EITC, the IRS has several publications to assist you. In short, there are specific requirements for the EITC including age, earned income, and qualified dependent criteria, to which you must qualify for. Also, if you are married, you cannot file as "Married Filing Single" and claim the EITC.

2. Claiming Head of Household Status - Consider the following questions before claiming:

-

What makes you “unmarried”?

-

What is a closely-related dependent mean?

-

Have you correctly performed the “Support” and “Residency” tests?

-

Have you paid more than half of the cost to maintain a home for yourself and your qualifier?

3. Random Chance - Here's where being lucky or unlucky comes into play. The IRS uses a computer program to randomly select tax returns for audit purposes. According to the IRS, "Your return may be selected for examination on the basis of computer scoring. A computer program called the Discriminant Inventory Function System (DIF) assigns a numeric score to each individual and some corporate tax returns after they have been processed. If your return is selected because of a high score under the DIF system, the potential is high that an examination of your return will result in a change to your income tax liability."

4. Reporting Income - During the course of the year you may or may not incur 1099 income. If you accidentally forget to include this information in your return it will cause IRS issues for you. Be sure to include all of your income when filing your taxes.

5. Missing Information - The IRS requires that specific information be included on your tax return otherwise it will be rejected. This information includes your signature, SSNs, date, and filing status. Leaving out this information can result in he return of your tax return, the delay of any refund you were expecting, and also the possibility of audit.

Never give the IRS a reason to further “examine” your tax returns. People usually get audited because the information they provided; the income, expenses and credit information just doesn’t add up and the IRS wants to know why. While it’s impossible to avoid all tax audits (because some are randomly selected), staying compliant will go a long way toward audit prevention.

If you are an individual or small business who is under audit or are concerned about being audited in the future, it is in your best interest to consult a qualified tax professional experienced in IRS audits to discuss your tax options and an audit strategy. At The Tax Office, Inc., we’ll champion your cause with the proper government agency to gain a satisfactory solution to your collection, audit or other tax representation issues.

Contact us for a confidential, no cost or obligation discussion of your tax issues, or call at ![]() 916-773-7053.

916-773-7053.